Are you tired of feeling like your credit score is holding you back from achieving your dreams? Whether it’s securing that perfect home, landing a new job, or finally making that big purchase you’ve been eyeing, a healthy credit score can open doors you never thought possible. Enter SharkShop’s Credit Solutions! In this blog post,

we’ll dive into how Sharkshop.biz can be your ultimate ally on the journey to financial empowerment. With tailored strategies and expert guidance designed just for you, say goodbye to confusion and frustration—it’s time to transform your credit profile and unlock a brighter financial future. Ready to take the plunge? Let’s explore how SharkShop can help pave the way to better credit today!

Introduction to Credit Scores and Why They Matter

Credit scores can feel like a mysterious number that influences many aspects of our financial lives. From securing loans to renting your dream apartment, a good credit score opens doors and provides opportunities. But what if you find yourself struggling with less-than-stellar credit? That’s where Sharkshop.biz comes in.

By understanding the ins and outs of credit scores, you can take charge of your financial future. With the right solutions at your fingertips, improving your score is not just a possibility—it’s an achievable goal. Let’s explore how SharkShop’s tailored services can guide you toward better credit health and pave the way for new possibilities!

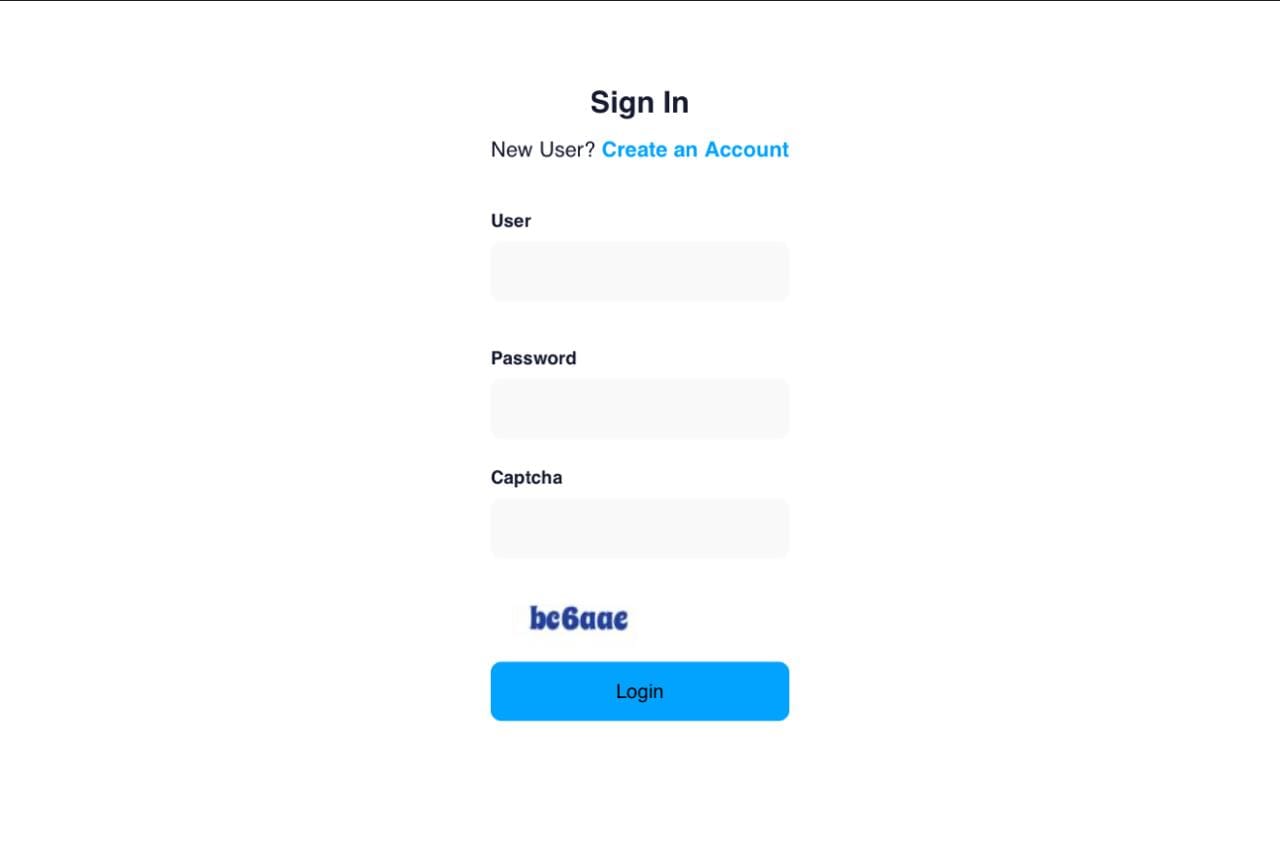

A Screenshot of Sharkshop (Sharkshop.biz) login page

Understanding the Factors that Affect Your Credit Score

Credit scores are influenced by several key factors. Payment history plays a significant role, accounting for about 35% of your score. Consistently paying bills on time can boost your credit health.

Another crucial aspect is the amount owed, which makes up around 30%. High credit utilization ratios can signal risk to lenders. Keeping balances low relative to credit limits is essential.

Length of credit history also matters. A longer track record demonstrates reliability and stability, contributing positively to your score.

New credit inquiries and types of accounts make up the remaining percentages. Applying for multiple new accounts in a short period can lower your score temporarily due to hard inquiries.

Understanding these components helps you take actionable steps toward improving your financial standing with SharkShop expert guidance.

Common Credit Score Myths Debunked

Many people hold misconceptions about credit scores that can lead to confusion and poor financial decisions. One prevalent myth is that checking your own credit score will hurt it. In reality, this is known as a “soft inquiry,” which does not impact your score at all.

Another common belief is that carrying a balance on your credit card improves your score. This isn’t true; in fact, keeping balances low or paying them off entirely helps maintain a healthy credit utilization rate.

Some think closing old accounts boosts their score, but it often has the opposite effect. Length of credit history plays an essential role in determining scores, so keeping those older accounts open can be beneficial.

Lastly, many believe income level directly affects their score. While income matters for loan approvals, it doesn’t factor into the actual calculation of the credit score itself. Understanding these myths clears up confusion and empowers better financial choices.

Related: Feshop

How SharkShop’s Credit Solutions Can Help Improve Your Credit Score

SharkShop’s Credit Solutions offers a tailored approach to improving your credit score. With their expert guidance, you can navigate the complexities of credit management with ease.

The program focuses on identifying and addressing negative factors affecting your score. This includes disputing inaccuracies on your report and providing strategies for better financial habits.

Additionally, SharkShop emphasizes education. They equip you with knowledge about effective credit usage, helping you make informed decisions moving forward.

One standout feature is their personalized action plan. Each client receives specific recommendations based on their unique situation. This targeted strategy ensures that every step taken is purposeful and impactful.

Moreover, the supportive community at SharkShop encourages accountability. You’re not just another number; they genuinely care about your progress and success in achieving a healthier credit profile.

Testimonials from Satisfied Customers

SharkShop login has transformed the lives of countless customers. Their stories highlight the effectiveness of our credit solutions.

One customer shared how their credit score jumped by over 100 points in just a few months. They felt empowered to purchase their first home, a dream they thought was out of reach.

Another user praised SharkShop’s personalized approach. The guidance and support offered were instrumental in navigating complex credit challenges.

Many clients appreciate the transparent communication throughout the process. They felt informed and involved every step of the way, which built trust with our team.

These testimonials reflect more than numbers; they embody hope and new beginnings for individuals eager to improve their financial futures. Each story is unique but shares one common thread: a renewed sense of confidence in managing credit effectively through SharkShop’s expert help.

The Process of Using SharkShop’s Credit Solutions

Using SharkShop’s Credit Solutions is a straightforward process designed to cater to your needs.

First, you start by signing up on the website. This step only takes a few minutes and requires basic information about yourself.

Next, you’ll complete an online assessment. This helps the team understand your current credit situation and identify areas that need improvement.

Once you’ve submitted the necessary details, expert advisors will review your profile. They will create a personalized plan tailored specifically for you.

Throughout this journey, communication remains open. You can easily reach out with questions or concerns at any time.

As you implement their strategies, you’ll receive ongoing support and resources aimed at boosting your score effectively. Expect regular updates to track your progress along the way!

Tips for Maintaining a Good Credit Score

Maintaining a good credit score is essential for financial health. Start by paying your bills on time. Late payments can significantly impact your score.

Keep your credit utilization low. Aim to use less than 30% of your available credit limit. This shows lenders you’re responsible with borrowing.

Regularly check your credit report for errors. Disputing inaccuracies quickly can prevent damage to your score.

Diversify your types of credit responsibly, like mixing installment loans and revolving accounts. A varied profile can enhance your credibility in the eyes of lenders.

Avoid opening too many new accounts at once; this creates multiple hard inquiries which may lower your score temporarily.

Finally, be patient and consistent with these practices, as building a strong credit history takes time and diligence.

Frequently Asked Questions About SharkShop’s Credit Solutions

Many people have questions about SharkShop cc Credit Solutions. Understanding these services is essential for making informed decisions.

One common inquiry is, “How quickly can I see improvements in my credit score?” Results vary based on individual circumstances, but many users notice changes within a few months.

Another frequent question revolves around cost. SharkShop offers various plans to accommodate different budgets, ensuring everyone has access to resources that can help them improve their credit standing.

Clients also wonder if using these solutions will negatively impact their score. Thankfully, engaging with SharkShop’s services does not damage your score; instead, it provides guidance on how to enhance it effectively.

Lastly, potential clients often ask about the support available during the process. The team at SharkShop is dedicated to providing personalized assistance and answering any queries you may have along the way.

Conclusion: Take Control of Your Credit Score with SharkShop

Your credit score plays a crucial role in your financial life. It affects everything from loan approvals to interest rates and even job opportunities. Understanding its importance is the first step toward better financial health.

Many factors influence your Sharkshop.biz credit score, including payment history, credit utilization, and types of credit accounts. By being aware of these elements, you can take proactive steps to improve your score.

There are many myths surrounding credit scores that can lead to confusion. For instance, some people believe checking their own score harms it or that closing old accounts will always help improve it. Debunking these misconceptions empowers individuals to make informed decisions about their credit journey.

SharkShop’s Credit Solutions offers tools tailored for those who want a better grasp on their finances. Their services focus on personalized strategies designed specifically for improving individual scores through practical advice and resources.

Customer feedback highlights the effectiveness of SharkShop’s approach. Many users report significant improvements in their scores within months of utilizing these solutions, showcasing real success stories that inspire confidence.

The process with SharkShop is straightforward and user-friendly. After an initial consultation where goals are established, they provide a customized plan focused on actionable steps—making improvement attainable for everyone.

Maintaining a good credit score requires ongoing effort but isn’t complicated if you stick to best practices like paying bills on time and keeping debt levels low. Regularly monitoring your progress also helps keep you accountable.

If you’re curious about how SharkShop can assist further or have specific questions regarding their offerings, don’t hesitate to reach out directly for clarity—they’re eager to help guide you through every step along the way!

Taking control of your financial future starts with understanding and improving your credit score—and with SharkShop by your side, achieving this goal becomes much more manageable.