Introduction

In the ever-evolving world of digital transactions, the need for secure, efficient, and seamless payment methods has grown exponentially. For businesses and consumers alike, payment gateways are the backbone of e-commerce, enabling online payments for goods and services. One of the most significant innovations in the payment processing landscape is the rise of platform-based payment gateways.

Platform-based payment gateways are solutions designed to integrate payment processing with various services and platforms, including e-commerce sites, mobile apps, and digital marketplaces. These platforms enable businesses to process payments securely, providing a smooth transaction experience for their customers. We will explore the features, benefits, challenges, trends and innovations surrounding platform-based payment gateways.

Definition

A platform-based payment gateway is a service that enables businesses to process online payments by integrating with their existing platforms or websites. It acts as an intermediary between customers and merchants, securely handling payment transactions through various methods such as credit cards, debit cards, and digital wallets. These gateways provide the infrastructure for seamless, secure, and efficient payment processing, often offering features like fraud protection, reporting, and multi-currency support to enhance the user experience.

What Are Platform-Based Payment Gateways?

Platform-based payment gateways act as intermediaries between merchants, customers, and financial institutions. Unlike traditional payment systems, which are standalone solutions, platform-based payment gateways operate within a broader ecosystem that facilitates not just payment acceptance, but also enhances the overall experience for merchants and their customers.

These gateways typically integrate seamlessly into platforms, whether it’s an online store, mobile app, or digital service, making it easier for users to make payments in a way that suits their preferences (credit card, debit card, e-wallet, or bank transfer). They process payments, handle security protocols, and manage the complex task of converting one currency to another.

Key Features of Platform-Based Payment Gateways

Multi-Platform Integration:

One of the primary features of platform-based payment gateways is their ability to integrate with a wide range of platforms. This includes e-commerce websites, mobile apps, social media platforms, and even brick-and-mortar store systems. Whether it’s a shopping cart on a website or an app offering in-app purchases, platform-based payment gateways can support various transaction environments seamlessly.

Security and Fraud Prevention:

Security is paramount in any online payment system. Payment gateways are designed with robust encryption and fraud detection mechanisms to ensure that both the merchant and consumer are protected. Features like tokenization, Secure Socket Layer (SSL) encryption, and multi-factor authentication are standard practices in modern payment gateways to prevent fraudulent activities and data breaches.

Global Payment Support:

A major benefit of platform-based payment gateways is their ability to accept payments from customers worldwide. These gateways can process multiple currencies, enabling businesses to expand their reach to international markets without the complexities of setting up separate payment systems for each country.

Recurring Billing and Subscription Management:

Many businesses today offer subscription-based services or products. Platform-based payment gateways often include tools for managing recurring billing, providing automatic charge scheduling, handling payment retries, and sending payment notifications. Businesses find it simpler to maintain long-term client connections as a result.

Mobile Optimization:

With the rise of mobile commerce, it’s essential for payment gateways to be optimized for mobile devices. Most platform-based gateways offer mobile-friendly interfaces and apps, ensuring that users have a seamless payment experience whether they are on a desktop, tablet, or smartphone.

Real-Time Transaction Processing:

Another critical feature of these gateways is real-time transaction processing. This enables both the merchant and the customer to instantly know whether the payment was successful or failed. It reduces the time between transaction initiation and confirmation, improving the overall user experience.

Customizable Payment Flows:

Platform-based payment gateways often come with customizable features that allow merchants to adjust the payment flow according to their needs. For instance, businesses can configure whether to show payment options immediately or collect additional information before payment.

Benefits of Platform-Based Payment Gateways

Increased Efficiency: By integrating payments directly into an online platform, businesses can streamline their operations, reducing the need for multiple payment solutions. This integration minimizes manual tasks and the risk of errors while improving the speed of transactions.

Improved Customer Experience: A well-integrated payment gateway creates a smooth and seamless experience for customers. With multiple payment options, quick processing times, and enhanced security, users are more likely to complete their purchases. This leads to higher conversion rates for businesses and increased customer satisfaction.

Cost Savings: Platform-based payment gateways often come with lower setup and maintenance costs compared to traditional payment systems. Additionally, the ability to handle multiple currencies and countries means businesses don’t have to invest in separate systems for each market, lowering overall costs.

Scalability: As businesses grow, so do their payment needs. Platform-based payment gateways can easily scale to handle higher transaction volumes, multiple payment methods, and international expansion. This makes them ideal for startups and large enterprises alike, providing flexibility for businesses at any stage.

Compliance with Regulations: Payment gateways must adhere to stringent regulations, including PCI-DSS (Payment Card Industry Data Security Standard). Platform-based gateways often come with built-in features that ensure compliance, saving businesses from the hassle and cost of ensuring that their own systems meet these standards.

Challenges in Adopting Platform-Based Payment Gateways

While platform-based payment gateways offer numerous advantages, there are several challenges businesses may face when adopting these solutions.

Integration Complexity:

Integrating a payment gateway into an existing platform can be a complex process, especially for businesses with legacy systems. It may require extensive technical knowledge and resources, and the process may disrupt business operations if not properly managed.

Security Concerns:

Despite having strong security protocols, no payment gateway is immune to cyber threats. Hackers may attempt to exploit vulnerabilities in the system, requiring continuous monitoring and updates to ensure the safety of sensitive payment data.

Customer Trust:

Even with the latest security measures, some customers may still feel hesitant about sharing their financial information online. Building trust through transparent policies, clear communication, and visible security certifications can help mitigate this issue.

Transaction Fees:

While platform-based payment gateways often offer lower costs than traditional systems, businesses may still face transaction fees that can add up over time. It’s essential for merchants to review the fee structures and determine the most cost-effective solution for their needs.

Trends and Innovations in Platform-Based Payment Gateways

Artificial Intelligence and Machine Learning:

AI and machine learning are becoming integral in payment gateways, especially in fraud detection and prevention. These technologies analyze transaction patterns in real time, identifying suspicious behavior and preventing fraud before it occurs.

Biometric Authentication:

As security concerns grow, biometric authentication, such as facial recognition and fingerprint scanning, is being integrated into payment systems to add an extra layer of security. This innovation helps to protect both merchants and customers from identity theft.

Blockchain Technology:

Blockchain is making waves in payment systems by providing a decentralized and highly secure method of processing transactions. Many platform-based gateways are beginning to explore blockchain integration to enhance transparency, reduce fraud, and lower transaction costs.

Digital Wallets and Cryptocurrencies:

Digital wallets like PayPal, Apple Pay, and Google Wallet, as well as cryptocurrencies like Bitcoin and Ethereum, are rapidly becoming popular payment methods. Payment gateways are adapting to support these alternatives, providing consumers with more choices in how they pay.

Voice-Activated Payments:

With the growth of virtual assistants like Alexa and Google Assistant, voice-activated payments are gaining traction. Platform-based payment gateways are increasingly incorporating this feature, enabling users to make payments through voice commands.

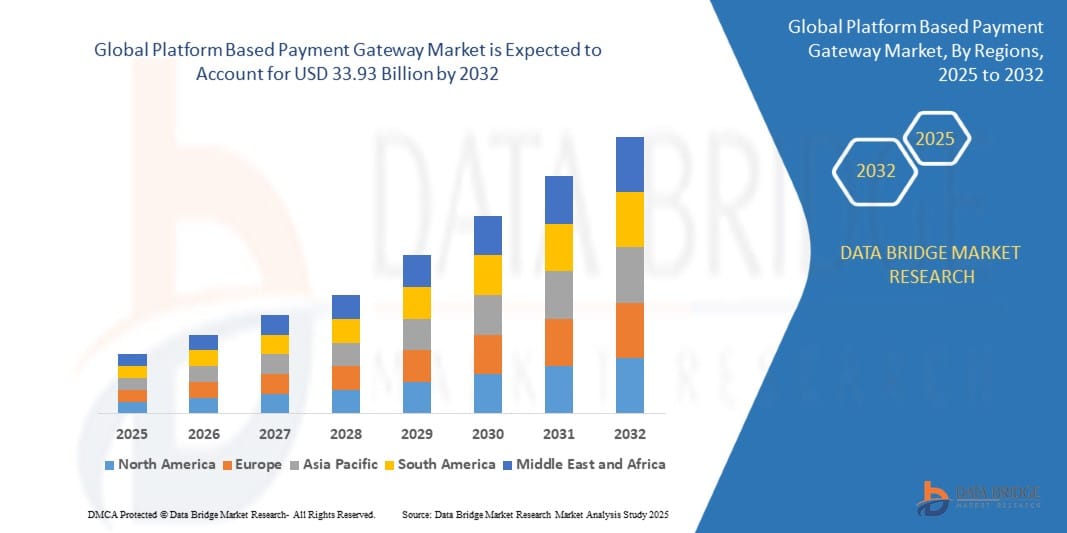

Growth Rate of Platform Based Payment Gateway Market

According to Data Bridge Market Research, the size of the global platform-based payment gateway market was estimated at USD 26.37 billion in 2024 and is expected to grow at a compound annual growth rate (CAGR) of 3.20% from 2025 to 2032, reaching USD 33.93 billion.

Read More: https://www.databridgemarketresearch.com/reports/global-platform-based-payment-gateway-market

Conclusion

Platform-based payment gateways are revolutionizing the way businesses process transactions by offering secure, efficient, and scalable solutions that integrate seamlessly with various digital platforms. With features like global payment support, mobile optimization, and enhanced security, these gateways provide numerous benefits to merchants and consumers alike. However, businesses must also navigate challenges such as integration complexities, security concerns, and transaction fees. By staying abreast of emerging trends and innovations like AI, blockchain, and biometric authentication, merchants can future-proof their payment systems and continue to provide an excellent experience to their customers in an increasingly digital world.